Description

About Accelerator Course

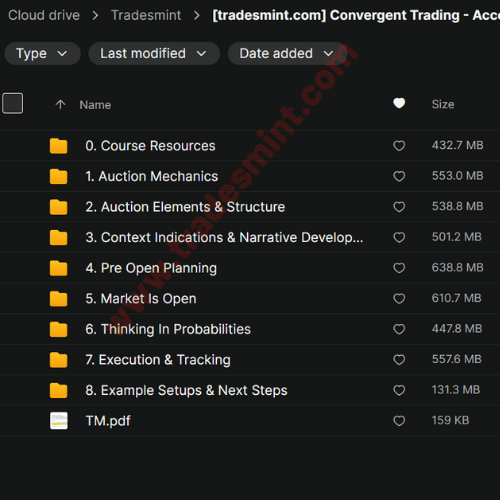

CT Accelerator Course

- Created by pro traders.

- Designed to provide a holistic understanding of how to operate as a trader.

- Covers topics such as auction mechanics, structure, context development execution and much more.

- 6 trading setups for demonstration purposes.

- Chart definitions downloads for Investor/RT, Sierra Chart or MotiveWave/EdgeProX.

- Auction Overview

Setting Expectations; Tools We Use; What is the Basis for a Trade; The Auction Overview.

- Auction Mechanics

Auction Mechanics; Trading Time Frames and Identity; Session Phases; Market Regimes, Organizing Market Data.

- Auction Elements & Structure

Auctioned vs. Unauctioned Areas; Value Areas and What They Tell Us; Point of Control; Profile Shapes.

- Context Indications & Narrative Development

Clues from the End of a Day; Excess & Failed Auction Areas; Weak Highs & Lows – Unfinished Auctions; Where We Open Against Any of These Characteristics; Composites & Micro-Composites; Reading Developing Markets; Extracting Tradable Data from Profiles; Building Multi-Day Context; Top-Down Analysis.

- Pre-Open Planning

The Price Map and Key Components; Price Map Creation Process; Gap Trading; Imbalance Opening Conditions against pSession; Balance Opening Conditions against pSession; Scenarios for Market Conditions; Role of Harmonics in Zone Development.

- Market is Open

Opening Indications; Price Action; Higher Probability Price Action Patterns; Using Day Generated Prices (DGPs); Judging Progress Based on Bracket Rotations.

- Thinking in Probabilities

Every Trade is an Independent Event; The Outcome Quadrant; Edge is an Indication of High Probability of a Win; The Random Tick Generator; Key Stats We Focus On; Sizing for Risk; Risk Clichés are True; Managing Streaks; Focusing on Covering Risk First.

- Execution & Tracking

Factors in Executing Trades; Using Order Flow; Pulling the Trigger; Tracking Errors; Executing Based on DGPs; Managing the Trade; Structured Trade Management vs Scalps; Executing ahead of, through & after News Events.

- Example Setups &

6 examples of trading setups we use; next steps for you to continue making progress.

Reviews

There are no reviews yet